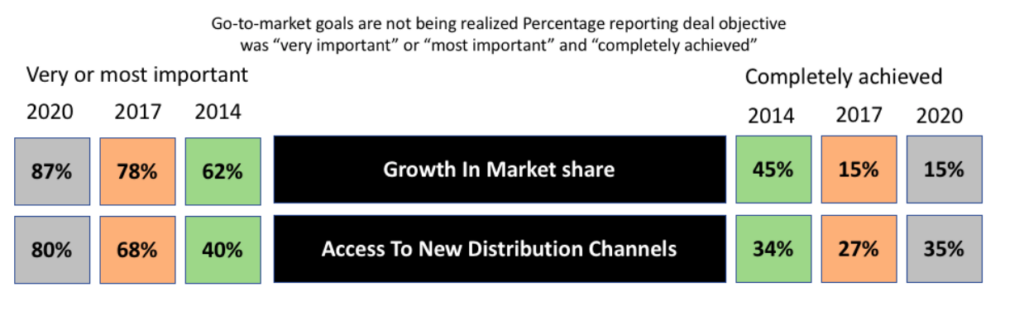

According to PwC’s tri-annual M&A Integration survey conducted in 2020, private equity firms are achieving greater financial and operational success with their deals, but strategic success is getting harder to come by these days. It’s interesting to point out that go-to-market goals are not being realized even as they grow in importance to deal makers.

Two in particular stand out:

1) Growth in Market Share, and

2) Access to New Distribution Channels

For those firms whose deal objective was seeking growth in market share, its strategic importance grew from 62% to 87% over the last three studies, while success rates in achieving those goals fell dramatically—from 45% in 2014 to just 15% in the latest 2020 study. This indicates there’s a wide chasm between what these deals aim to deliver strategically and how well they actually do.

The percentage of companies that reported success in gaining access to new distribution channels remained virtually the same at 35%, while its importance doubled from 40% to 80%. It turns out leveraging new distribution channels is a more complex and difficult task than anticipated.

To win in today’s environment, PEs need to go beyond adding value through financial engineering and operational enhancements. While profitability is certainly important, over a 3-5 year time horizon a company’s demonstrated rate of growth has become an even more important driver of future valuation. So it is critical to focus on top line growth of your portfolio companies to organically create value — and do it quickly.

At Drucker Group, our Voice of Customer research helps clients realize the compounded benefits of driving higher growth from a lower cost structure — taking full advantage of a portfolio company’s improved operational flexibility to drive a portfolio company’s increased market share.

First, the insights-gathering process helps deliver a better understanding of the market, key customers, their buying behavior, needs and unmet needs, and how a new market structures around product and service attributes and associated customer benefits. Strategic Planning efforts improve, as do sales and marketing initiatives, communications programs, new product development and channel strategies, which all leverage these customer insights.

These VOC insights also drive a proactive mentality in a company’s overall sales & marketing campaigns. The best defense is a strong offense. You know what’s most important to customers, and what’s not. How purchasing teams consider you in their best value option analysis (BVOA). How stakeholders across the value chain truly view your brand. Which helps you align selling messages to emphasize your strengths. And ultimately helps (and not hinders) the sales team in their pursuit of new business.

Once you possess a deeper understanding of how buying decisions are made from the customer’s perspective, your organic growth efforts can become a primary focus of engagement with your portfolio companies, so that you’re not relying solely on cost containment levers to achieve success.

Download our VOC white paper or contact us to learn more.